sales tax oklahoma tulsa ok

The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions.

The Fiscally Responsible Way To Reduce Taxes On Groceries Oklahoma Policy Institute

While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does.

. The Oklahoma sales tax rate is currently. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax. 31 rows Norman OK Sales Tax Rate.

This is the total of state county and city sales tax rates. Tulsa County OK Sales Tax Rate. The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county sales.

Ponca City OK Sales Tax Rate. Depending on local municipalities the total tax rate can be as high as 115. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is.

Average Sales Tax With Local. Some local sales taxes are for general purposes and some are dedicated or. The Tulsa County sales tax rate is.

Other local-level tax rates in the state of Oklahoma are. There are a total of 470. The Oklahoma OK state sales tax rate is currently 45.

For vehicles that are being rented or leased see see taxation of leases and rentals. 7288 TULSA CTY 0367 7388 WAGONER CTY 130 7488 6610 WASHINGTON CTY 0409 1 7588 WASHITA CTY 2 7688 WOODS CTY 050 7788 WOODWARD CTY 090 Rates. Sales Tax News Release City Tax Rate May 2022 Revenue May 2021 Tax Rate Revenue ADDINGTON 002 9289 002 34962 ATWOOD 002 63133 002 49684 Page 1.

In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax. The December 2020 total local sales tax rate was also 4867.

The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365. Oklahoma City OK Sales Tax Rate. Owasso OK Sales Tax Rate.

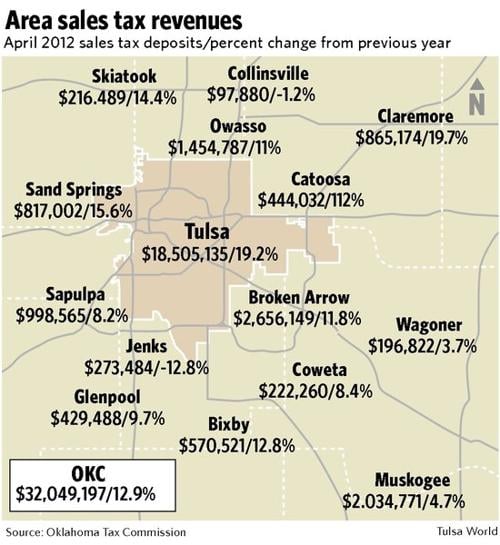

This is the total of state and county sales tax rates. Some cities and local. Sales in the two largest cities Oklahoma City and Tulsa are taxed at total rates between 8 and 9 percent.

The Oklahoma OK state sales tax rate is currently 45 ranking 36th-highest in the US. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. The Oklahoma OK state sales tax rate is currently 45.

Sales Tax State Local Sales Tax on Food. An example of an item that exempt from Oklahoma is. Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65.

Sales Tax in Tulsa. Tulsa County - 0367. State of Oklahoma - 45.

The Tulsa County Sales Tax is 0367. The 2018 United States Supreme Court decision in. A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax.

Depending on local municipalities the total tax rate can be as high as 115. There is no applicable special tax. The Oklahoma state sales tax rate is currently.

Sales Use Tax AnalystTulsa OKWe are currently hiring a Sales and Use Tax Analyst to join an established team of finance and accounting professionals in. This page covers the most important aspects of Oklahomas sales tax with respects to vehicle purchases. Counties and cities can charge an additional local sales tax of up to 65 for a.

There is no applicable. Tulsa Oklahoma and Miami Florida. See reviews photos directions phone numbers and more for Oklahoma Sales Tax locations in Tulsa OK.

Job in Tulsa - Tulsa County - OK Oklahoma - USA 74145. The current total local sales tax rate in Tulsa County OK is 4867.

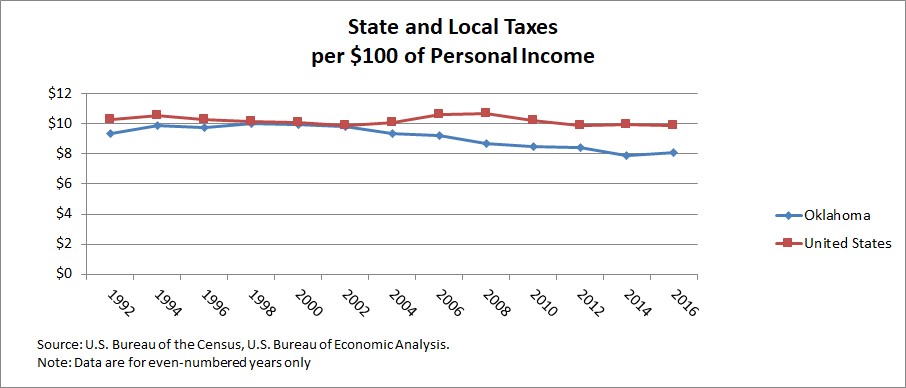

Oklahoma Tax History Oklahoma Policy Institute

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

Tax Forms Tax Information Tulsa Library

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Sales Tax Exemption Letter For Oklahoma State Gov T Entities

Taxes Broken Arrow Ok Economic Development

Ok Sales Tax Rebate Tulsa City Fill Out Tax Template Online Us Legal Forms

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Oklahoma Lawmakers Discuss Eliminating State Sales Tax On Groceries

The Fiscally Responsible Way To Reduce Taxes On Groceries Oklahoma Policy Institute

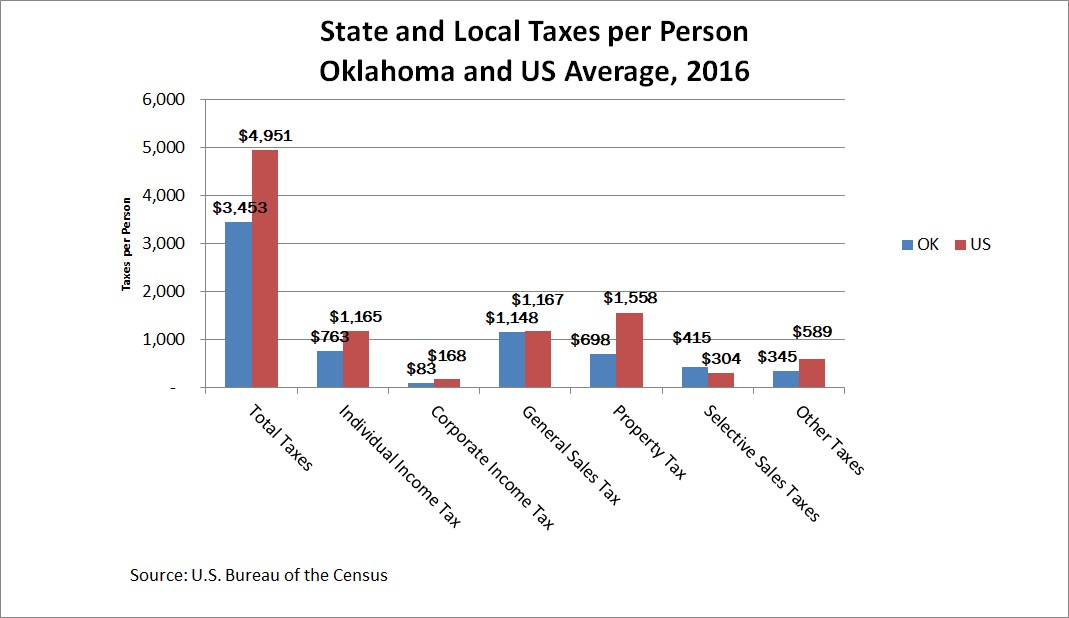

Oklahoma S Tax Mix Oklahoma Policy Institute

Oklahoma Center For Community And Justice Home Facebook

Oklahoma Sales Tax Small Business Guide Truic

Total Sales Tax Per Dollar By City Oklahoma Watch

How Oklahoma Taxes Compare Oklahoma Policy Institute

Oklahoma Sales Tax Guide And Calculator 2022 Taxjar

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867